Annual report on the financial statements of TMEDE’s fifth operating period, from 01/01/2021 to 31/12/2021, following International Financial Reporting Standards

The fifth annual report on the financial statements for TMEDE’s operating period, from 01/01/2021 to 31/12/2021, was announced following the completion of the Independent Certified Public Accountants and the issuance of the respective Unqualified Opinion Independent Auditor’s Report.

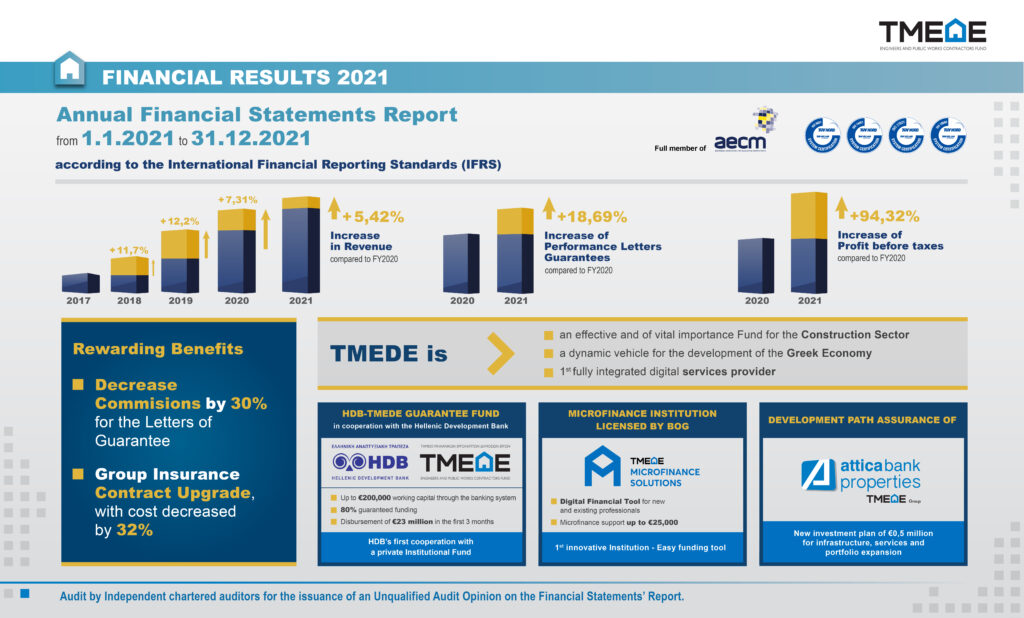

In compliance with its statutory provisions and the International Financial Reporting Standards, TMEDE’s fifth fiscal year, from 01/01/2021 to 31/12/2021, reflects the steady upward trend of the Fund since its establishment, as a result of its growth strategy, turnover increase and positive results.

Indicative of the Fund’s dynamic course and vital contribution, as a guarantee and credit institution, to the development of the sector is the doubling of profitability before taxes, combined with the increase in revenues by 5.42% and the significant increase in the issuance of guarantees compared to the previous financial year. It is worth noting that the rise of guarantee issuance was recorded both in terms of numbers, by 18.69% (9.220 new letters of guarantee in 2021, compared to 7.768 ones, in 2020), and in terms of funds, by 18.63% (€89,62 million in 2021, compared to €75,55 million in 2020), which is expected to have a strong positive impact on the financial results of the following fiscal years.

In particular, despite the turbulence still generated by the pandemic and the geopolitical disruptions due to the war in Ukraine, the Fund managed – although it reduced the commissions paid by its members for the Letters of Guarantee – to increase its turnover in 2021 to €8,978 million compared to €8,517 million in 2020, maintaining the same positive EBITDA level of €1.57 million, while achieving a significant increase in profit before taxes in 2021, which reached €11,4 million, compared to €5,9 million in 2020.

As an active and pioneering member of the European Mutual Guarantee Association (AECM) and in creative cooperation with the supervising Ministry of Labour and Social Affairs, the Ministries of Infrastructure – Transport and Development, and the Hellenic Development Bank (HDB), TMEDE, developing coherent planning, determination and achieving its business objectives, enters a new dynamic era, expanding its credit and development role.

In particular, TMEDE:

- Created in cooperation with the Hellenic Development Bank, the “HDB-TMEDE Guarantee Fund”, from which beneficiaries can receive working capital, through the banking system, up to €200,000, with the Fund assuming a part of the credit risk by providing a guarantee to the banks for 80% of the funding. It is the first partnership between the HDB and a private institutional fund. In the first four months of the HDB-TMEDE Guarantee Fund operation, more than €23 million has been disbursed and channeled into the market, representing over 34% of the total available portfolio.

- Established a new microfinance institution, “TMEDE Microfinance Solutions”, licensed by the Bank of Greece. Through this innovative tool, TMEDE meets, in a comprehensive way, the needs of its members for seamless access to funding, especially for those who are just starting their professional careers.

- Ensured the development of Attica Bank Properties SA by implementing, as a 100% shareholder, a new forward business plan, providing for investments of €0.5 million for 2021, accelerating its digital transformation, designing and developing new services, enhancing its human resources and upgrading its infrastructure with a view to expanding its portfolio and developing its services.

- Is actively participating, together with the US-based Ellington Investment Fund, in the complete transformation and development of Attica Bank through its privatization on market terms.

- Enhanced, amid COVID-19, its benefits through significant upgrades to its members’ Group Insurance Scheme, offering, amongst others, new insurance policies while reducing Insurance costs by 32%. In addition, from 01/01/2021 – 31/03/2021, it further decreased the Letters of Guarantee commissions by 30%.

Concurrently, the Fund is exploring the use of new financial tools and instruments to strengthen guarantee and credit resources, through the AECM, the European Investment Fund (EIF) and others, in cooperation with the Ministry of Development and the Hellenic Development Bank.

As the first and most innovative integrated digital service provider, it has reaffirmed its commitment to high-quality services by renewing two important certifications, ISO 37001: 2016- Anti-Bribery Management System and ISO 19600:2014 – Compliance Management System. In addition, the Fund, in the framework of improving internal transparency and sound governance principles, in March 2022, commissioned an independent consultant to assess the policies and suitability of its Management Members within a reporting period of the fiscal year 2021, utilizing a mix of its own tools and the ones used by the Fund as part of the self-assessment process provided for in its policies.

TMEDE, as a self-financed organization, meets the purpose of its establishment, becoming a vitally important Fund for the construction sector and a dynamic growth multiplier for the Greek economy, expanding its members with new professionals and scientists such as economists, geologists, foresters, agronomists, etc. Furthermore, TMEDE is creating a constantly evolving dynamic guarantee and credit ecosystem through strategic partnerships and investment initiatives.