New Board of Directors in TMEDE – Renewal of the four-year term of office of Mr Makedos as President

TMEDE has announced the names of its new BoD, following the favourable decision of the Technical Chamber of Greece to continue supporting its representatives, Mr K. Makedos and Mr I. Machikas, and the relevant decision of the Minister of Labour and Social Affairs, Mr Konstantinos Hatzidakis, as a result of the Fund’s sustained growth and the support it has been offering to the Engineers and Public Works Contractors in our country. Furthermore, the term of office of the President of TMEDE, Mr Konstantinos Makedos, was renewed for four years.

Five years after its establishment, TMEDE is constantly evolving, changing and progressing, increasing its footprint and strengthening its guarantee and lending role. As part of its business strategy, TMEDE is expanding its activities, participating thus in initiatives that promote growth and development. It is the first organisation to offer integrated digital services to its members since 2017.

In addition, TMEDE is actively involved, along with Ellington, a US investment fund, in fully transforming and developing Attica Bank through its privatisation on market terms and ensuring the development of Attica Bank Properties. At the same time, it has established a microfinance company. Furthermore, in cooperation with AECM, the European Association of Guarantee Institutions, and ΗDB, it puts forward initiatives for new investment tools to finance its members.

At the same time, for the 5th consecutive year and despite the adverse international economic climate, TMEDE has recorded positive financial results.

TMEDE serves the increased liquidity needs of its 30,000 borrowers and 5,500 small and medium-sized companies, thus actively contributing to market stimulation and creating the appropriate conditions for the restart of the national economy.

The President of TMEDE, during the first meeting of the new BoD, gave a brief account of the Fund’s main actions in 2021, stating that it:

- expanded the range of its borrowers-members with new professionals and scientists and, more specifically, freelance professionals with a contractor or design degree from the competent Directorate of the Δ15 register of the Ministry of Infrastructure and Transport, i.e. economists, geologists, foresters, agronomists.

- reduced the Good Performance Letter of Guarantee commission from 01/01/2021 to 31/03/2021 by 30%.

- introduced new financial tools and instruments to strengthen guarantee and credit resources through the AECM and other institutions, in cooperation with the Ministry of Development and the Hellenic Development Bank (HDB).

- was selected, following a tendering procedure and evaluation by the Hellenic Financial Stability Fund and the management of Attica Bank, as the preferred private investor, along with Ellington, to complete the transformation and privatization of Attica Bank, aiming to create a profitable, free of any burden sustainable Bank

- ensured the growth of Attica Bank Properties SA, as its 100% shareholder, by implementing a new business plan and a new forward-looking investment plan of €0.5 million for 2021. TMEDE

added its 21 properties to the existing 182 ones owned by Attica Bank to expand the portfolio and develop the offered services.

- received the relevant license from the Bank of Greece to establish a new microfinance body under the distinctive title “TMEDE Microfinance Solutions”, thus enhancing its members’ liquidity options.

- created, in cooperation with the Hellenic Development Bank, the “EAT-TMEDE Guarantee Fund”, where borrowers can receive working capital, through bank loans of up to €200,000, with the Fund assuming a part of the credit risk by providing a guarantee to the Banks for 80% of the financing.

The President of TMEDE, Mr Konstantinos Makedos, regarding the critical achievements of 2021, stated: “TMEDE is the main guarantee and credit ecosystem for the Engineers, Public Works Contractors and similar occupations. Its transformation into a modern self-financing organization strengthens its crediting role while increasing its growth footprint to support the professionals in the field, playing thus a leading role in the new economic model of our country”.

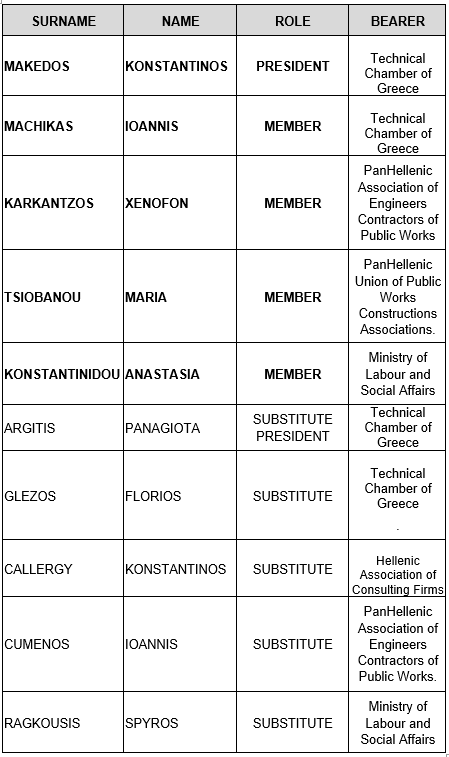

Composition of the new Board of Directors: